Topics

All

Civil Services in India (26)

Ethics, Integrity and Aptitude

» Chapters from Book (11)

» Case Studies (8)

Solved Ethics Papers

» CSE - 2013 (18)

» CSE - 2014 (19)

» CSE - 2015 (17)

» CSE - 2016 (18)

» CSE - 2017 (19)

» CSE - 2018 (19)

» CSE - 2019 (19)

» CSE - 2020 (19)

» CSE - 2021 (19)

» CSE -2022 (17)

» CSE-2023 (17)

Essay and Answer Writing

» Quotes (34)

» Moral Stories (18)

» Anecdotes (11)

» Beautiful Poems (10)

» Chapters from Book (5)

» UPSC Essays (40)

» Model Essays (38)

» Research and Studies (4)

Economics (NCERT) Notes

» Class IX (14)

» Class X (16)

» Class XI (55)

» Class XII (53)

Economics Current (51)

International Affairs (20)

Polity and Governance (61)

Misc (77)

Select Topic »

Civil Services in India (26)

Ethics, Integrity and Aptitude (-)

» Chapters from Book (11)

» Case Studies (8)

Solved Ethics Papers (-)

» CSE - 2013 (18)

» CSE - 2014 (19)

» CSE - 2015 (17)

» CSE - 2016 (18)

» CSE - 2017 (19)

» CSE - 2018 (19)

» CSE - 2019 (19)

» CSE - 2020 (19)

» CSE - 2021 (19)

» CSE -2022 (17)

» CSE-2023 (17)

Essay and Answer Writing (-)

» Quotes (34)

» Moral Stories (18)

» Anecdotes (11)

» Beautiful Poems (10)

» Chapters from Book (5)

» UPSC Essays (40)

» Model Essays (38)

» Research and Studies (4)

Economics (NCERT) Notes (-)

» Class IX (14)

» Class X (16)

» Class XI (55)

» Class XII (53)

Economics Current (51)

International Affairs (20)

Polity and Governance (61)

Misc (77)

Monetisation of state-owned infrastructures

Under the Union Budget 2021-22, the Monetization of Assets has been identified as one of the three pillars for enhanced and sustainable infrastructure financing in the country. The Budget also envisions the preparation of a “National Monetisation Pipeline” (NMP) to provide a direction to the monetisation initiative and visibility of investors. The policy has come under criticism from quarters that have warned against it reducing the state owned assets to a very small proportion. On this the finance minister, Nirmala Sitharaman has announced that the goal is to raise $81bn, or 3% of GDP, over four years. But rather than doing so through outright sales, the transactions will be more complex, and less transformative as a result. The Indian state will liquidate small minority stakes in a few airports. Other big assets are expected to be leased to investors for up to 25 years.

What does monetisation mean?

In a monetisation transaction, the government transfers revenue rights to private parties for a period of time, in return for upfront money, a revenue share, and commitment of investments in the assets. Real estate investment trusts (REITs) and infrastructure investment trusts (InvITs), for instance, are the key structures used to monetise assets in the roads and power sectors. These are also listed on stock exchanges, providing investors liquidity through secondary markets as well. While these are a structured financing vehicle, other monetisation models on PPP (Public Private Partnership) basis include: Operate Maintain Transfer (OMT), Toll Operate Transfer (TOT), and Operations, Maintenance & Development (OMD).

What is the National Monetisation Pipeline?

·The NMP has been created to be co-terminus with the balance National Infrastructure Pipeline period, 4 year period from 2022 to 2025.

·The NMP has been prepared based on inputs and consultations from the respective ministries and departments, along with an assessment of the total asset base available.

·The NMP is meant to serve as an essential roadmap for the asset monetisation of various brownfield infrastructure assets across roads, railways, shipping, aviation, power, telecom, oil & gas, and warehousing sectors.

·It is based on the philosophy of ‘Creation through Monetisation’

·It is expected that it will tap institutional investment and long term patient capital into stable mature assets in turn generating financial resources for new infrastructure asset creation

·The government has also constituted an empowered Core Group of Secretaries on Asset Monetization (CGAM) under the chairmanship of Cabinet Secretary.

Why is it important?

Amongst other things, economic performance relies heavily on investment in infrastructure and its growth. Benefits of higher investment in good quality infrastructure manifest in the form of increased employment opportunities, access to market and materials, improved quality of life and empowerment of vulnerable sections. Investment led growth has been central to the economic agenda of the government and one of the pre-requisites of Investment led growth is capital and asset recycling. Asset recycling and monetization is the key to value creation in Infrastructure by serving two critical objectives –

·Unlocking value from public investment in infrastructure

·Tapping private sector efficiencies in operations and management of infrastructure.

In the absence of adequate and robust infrastructure facilities, the economy operates at a sub-optimal level, distant from its potential and frontier growth. To bridge the existing infrastructure gaps and cater to its future potential and needs, the Government of India undertook an exercise in 2019-20, to lay the infrastructure vision for the country. Pursuant to this, the National Infrastructure Pipeline (‘NIP’), was released in December 2019. Soon after, the Covid-19 pandemic took a unprecedented toll on the economic activity in the country, and at present, it is felt that a significantly enhanced level of infrastructure investment is critical for reviving growth.

The Roadmap and Advantages

The NMP is designed to boost government fiscal resources. The National Infrastructure Pipeline (NIP), envisages 8,160 projects of which 23% have started, although progress is slower than expected.

The NMP is a scheme to establish structured contractual partnerships between the government and private players and thereby generate sustainable infrastructural funding by monetizing core brownfield infrastructural assets, that is, assets where operational infrastructure has already been built. The scheme will enable infrastructure creation through mutually beneficial collaboration between the public and private sectors, and deliver on the government’s socio-economic growth promises.

·The NMP roadmap identifies 13 core sectors under which assets are to be monetized.

·These identified assets will be leased out to the private sector on a long-term basis, applicable for four to five decades.

·The policy will be carried out in 2 stages: Preparatory and Transaction.

·The preparatory stage starts with a general guidance on the process towards asset identification and methods of monetisation, followed by internal administrative actions for formulation, appraisal, and approval process.

·The transaction stage involves asset monetisation processes across the key instruments identified. It covers the regulatory, the key institutional stakeholders, the documentation involved and the actual steps in the asset monetisation process for each instrument.

·Sectors and list of assets:

I.26,700 km of roads, railway stations, train operations and tracks

II.2,8608 Ckt km worth of power transmission lines

III.6 GW of hydroelectric and solar power assets

IV.2.86 lakh km of fibre assets and 14,917 towers in the telecom sector

V.8,154 km of natural gas pipelines and 3,930 km of petroleum product pipelines.

VI.15 railway stations

VII.25 airports

VIII.160 coal mining projects

IX.31 projects in 9 major ports

X.Redevelopment of various government colonies and hospitality assets including ITDC hotels is expected to generate Rs 15,000 crore.

·For each of these sectors, the NMP has been drawn for potential assets to be put up for monetization based on three key sets of information: Potential asset value; Asset considered for monetization; Indicative monetization value.

Monetising operational public assets as an additional source of much needed non-debt budgetary capital receipts is fiscally rational and mimics the deleveraging strategy corporates adopt, to sit-out a demand-compression-led economic downturn. The resort to monetisation is also an outcome of relatively slow movement on two previous fiscal initiatives. One is privatisation attempted from 1999 and the second is public private partnerships (PPP) started in 2010, but which floundered due to unsupportive governance structures and rigid contracts. Monetisation envisages the lease of specific assets for 15 to 30 years to a private anchor investor who could either hold the asset in a corporate or in a specially created Investment Trust. The government benefits from the receipt of lease rent, representing the present value of a portion of the profit expected to be earned by the lessee.

Monetisation can also enhance PSU productivity by restructuring business units without changing the enterprise ownership profile. Other than generating funds for growth, it enables a segmented strategy for enhancing productivity by leasing out business segments.

Challenges

Certain concerns have been raised regarding the conceptualisation and implementation of the policy. The anticipated transfer of assets, possibly into the hands of state cronies, has been a criticism of the government’s plans, especially since these have national strategic value. It is argued that in the long-term, the status of these projects will impact the interest of common citizens as there is currently no clarity on checks and price caps that the government will impose on these private players.

Concerns have also been raised concerning the valuation models and lack of identifiable revenue streams in various assets has been considered a challenge to attract diverse participation, inevitably raising the spectre of vested interests and corruption. Additionally, no dispute resolution mechanism has been specified in the roadmap laid out by the government. While the government has tried to address these challenges in the NMP framework, execution of the plan remains key to its success. Structuring of monetisation transactions is being seen as key. The slow pace of privatisation in government companies including Air India and BPCL, and less-than-encouraging bids in the recently launched PPP initiative in trains, indicate that attracting private investors interest is not easy.

Conclusion

There are chances of monetisation resulting in crony capitalism via the consolidation of control by industrial oligarchs. But even monopolies can and are regulated. To tackle contractual contingencies, resilient sector regulators in electricity, petroleum and gas, etc. and administrative departments like railways, coal and mines, etc. would need to remain vigilant of public interest being served. The entire process must satisfy the law of the land. It is an idea whose time has come.

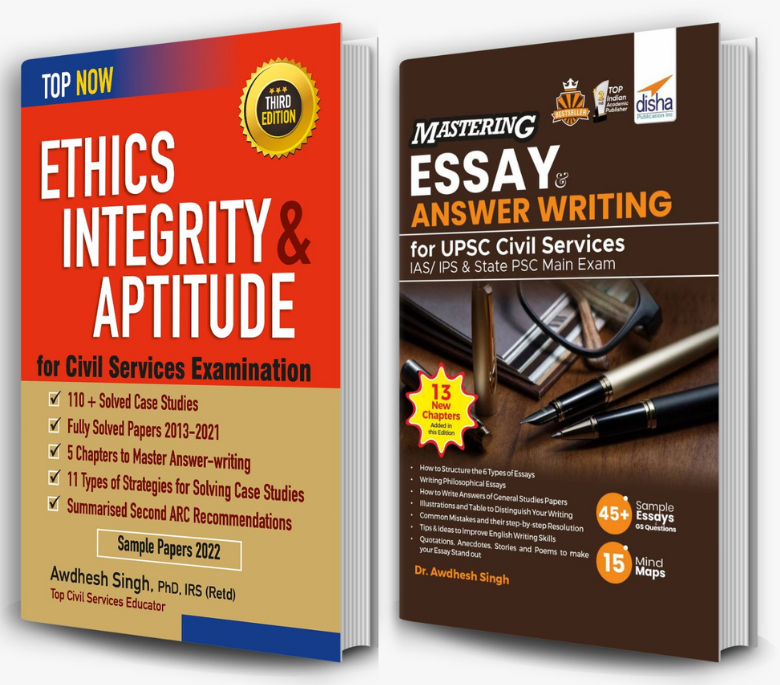

Looking for a One-stop Solution to prepare for ‘Ethics, Integrity, and Aptitude’ and ‘Essay and Answer Writing’ for UPSC?

Buy Dr. Awdhesh Singh’s books from the links below-

Buy Dr. Awdhesh Singh’s books from the links below-

Ethics, Integrity & Aptitude for Civil Services Examination

Amazon - https://amzn.to/3s1Qz7v

Flipkart - https://bit.ly/358N2uY

Mastering Essay & Answer Writing for UPSC Civil Services

Amazon - https://amzn.to/3JELE2h

Flipkart - https://bit.ly/3gVIwmv

| Related Articles |

| Recent Articles |