Essay and Answer Writing

Topics

All

Civil Services in India (26)

Ethics, Integrity and Aptitude

» Chapters from Book (11)

» Case Studies (8)

Solved Ethics Papers

» CSE - 2013 (18)

» CSE - 2014 (19)

» CSE - 2015 (17)

» CSE - 2016 (18)

» CSE - 2017 (19)

» CSE - 2018 (19)

» CSE - 2019 (19)

» CSE - 2020 (19)

» CSE - 2021 (19)

» CSE -2022 (17)

» CSE-2023 (17)

Essay and Answer Writing

» Quotes (34)

» Moral Stories (18)

» Anecdotes (11)

» Beautiful Poems (10)

» Chapters from Book (5)

» UPSC Essays (40)

» Model Essays (38)

» Research and Studies (4)

Economics (NCERT) Notes

» Class IX (14)

» Class X (16)

» Class XI (55)

» Class XII (53)

Economics Current (51)

International Affairs (20)

Polity and Governance (61)

Misc (77)

Select Topic »

Civil Services in India (26)

Ethics, Integrity and Aptitude (-)

» Chapters from Book (11)

» Case Studies (8)

Solved Ethics Papers (-)

» CSE - 2013 (18)

» CSE - 2014 (19)

» CSE - 2015 (17)

» CSE - 2016 (18)

» CSE - 2017 (19)

» CSE - 2018 (19)

» CSE - 2019 (19)

» CSE - 2020 (19)

» CSE - 2021 (19)

» CSE -2022 (17)

» CSE-2023 (17)

Essay and Answer Writing (-)

» Quotes (34)

» Moral Stories (18)

» Anecdotes (11)

» Beautiful Poems (10)

» Chapters from Book (5)

» UPSC Essays (40)

» Model Essays (38)

» Research and Studies (4)

Economics (NCERT) Notes (-)

» Class IX (14)

» Class X (16)

» Class XI (55)

» Class XII (53)

Economics Current (51)

International Affairs (20)

Polity and Governance (61)

Misc (77)

Non-Performing Assets in the banking sector: causes and solutions

As of March 31, 2018, provisional estimates suggested that the total volume of gross Non-Performing Assets (NPA) in the economy stood at Rs. 10.35 lakh crore, and about 85% of these were from loans and advances of the public sector banks. For instance, the NPAs in the State Bank of India were worth 2.23 lakh crore. The issue of NPAs in the Indian banking sector has infact become a subject of much scrutiny and concern. In 2019, in absolute terms, gross NPAs were estimated to touch Rs 2.50 lakh crores. As per the Standing Committee report in 2018, it was observed that the banks’ capacity to lend had been severely affected due to the mounting NPAs. Even the RBI in February 2018 regarded the timely resolution of NPAs the need of the hour. In this essay, we evaluate the rise of NPAs in the country, its causes, and some likely solutions.

(Source for the stats: prsindia.org)

What is NPA and why does it matter?

The Non-Performing Asset is any asset of a bank which is not producing any income. In other words, a loan or lease that is not meeting its stated principal and interest payments. Generally speaking there are 4 types of assets in the banking system:

·Standard assets - Assets which are generating regular income to the bank

·Sub-standard assets - An asset which is overdue for a period of more than 90 days but less than 12 months

·Doubtful assets - An asset which is overdue for a period of more than 12 months.

·Loss assets - Assets which are doubtful and considered as non-recoverable by bank, internal or external auditor or central bank inspectors

Sub-standard assets, Doubtful assets and Loss assets are all types of NPAs. The banking sector has been facing severe problems due to rising NPAs and the problem is faced primarily by the public sector banks. Loans or advances provided by the banks are considered as bank’s assets as banks earn interest on them. The businesses sometimes default on the loan repayments and this causes banking NPA. This is a problem because:

·NPA of the banks leads to scarcity of funds in the Indian Security Markets.

·Fewer banks are willing to lend if they are not sure of the recovery of their money.

·The shareholders of the banks lose money as banks themselves find it tough to survive in the market.

·Interest rates shoot up which directly impacts the investors which leads slowdown economy.

·People get into a debt trap, which is a vicious circle.

·NPAs cause slowdown in the economy, recession and inflation.

Causes of NPAs

(Sources: bankexamstoday.com / psrindia.com)

Irrational lending and deficiencies in evaluation and monitoring are among the factors that have resulted in Indian banks making bad loans worse. Some major causes are outlined as under:

·Before the financial crisis of 2008 India’s economy was in a booming. During this period banks lent extensively to corporates in the expectation that the good times will continue in future. The businesses of most of the corporates were adversely affected due to slowdown in the global economy following the financial crisis.

·Another major reason of rising NPA is the relaxed lending norms for corporate houses. Their financial status and credit rating are not analysed properly. The banks are willing to accept higher leverage and less promoter equity. Around 40% of the outstanding loans have been made to companies with interest coverage ratio less than one.

·Public Sector banks provide major portion of the credit to industries and it is this part of the credit distribution that forms a great portion of NPA.

·There are also cases of credit default by promoters, where the funds have been diverted by over-invoicing imports, sourced via, a promoter owned subsidiary abroad or exporting to shell companies and then declaring, that they defaulted.

·There are also borrowers who are competent enough to pay the loans but intentionally withdraw from it.

·Natural calamities – this is a measured factor that makes borrowers unable to pay.

·Inappropriate project handling, ineffective management, lack of resources and technology, changing policies, etc. are all factors causing NPAs.

Solutions and steps towards NPAs

(Source: elearnmarkets.com)

Government of India has been struggling to come up with solutions and has set up inter-creditor agreements to speed up resolution under the Insolvency and Bankruptcy Code (IBC). It has proposed a combination of a bank-led asset management company, alternate investment funds, and a platform to auction bad assets. To comprehend the scenario, as per estimate, there are nearly Rs 12 lakh crore of stressed assets in the country’s banking system. The steps being taken to resolve the NPAs can be classified into 2 kinds – Regulatory means (like IBC) and Remedial measures (by RBI).

The stressed asset constitutes 15% of the outstanding loan books of these banks. Banks have sold around Rs 2 lakh crore worth of such loans to asset reconstruction companies (ARCs), leaving about Rs 10 lakh crore on their own books. In such a scenario, the RBI direction on referring companies to the National Companies Law Tribunal (NCLT) can help tackle the NPA menace to a great extent. While the action plan details are being worked out, the process has already been initiated for a few cases.

As per the estimates, more than 70% of these cases will be restructuring wherein the debt will be reduced down to sustainable levels. It is estimated that around Rs 40,000-50,000 crore of additional capital will have to be infused to make these companies perform efficiently again. This will be infused by a mix of existing promoters, ARCs, stressed asset funds and private equity (PE) investors. These investors will also drive the turnaround for these companies through stronger management.

Conclusion

A strong banking sector is a necessity for a flourishing Industry. The failure of the banking sector can adversely impact other sectors of the industry. By providing lending services, banks create credit in the economy. More the credit in a society, more the economic activities in the industry. Therefore, credit helps an economy prosper. However the government can’t be expected to rescue the state-run banks with taxpayer’s money every time they fall into crisis. Right steps, timely and concerted action, and a revival of the Indian economy will put a lid on NPAs but it must become a priority than mere cure.

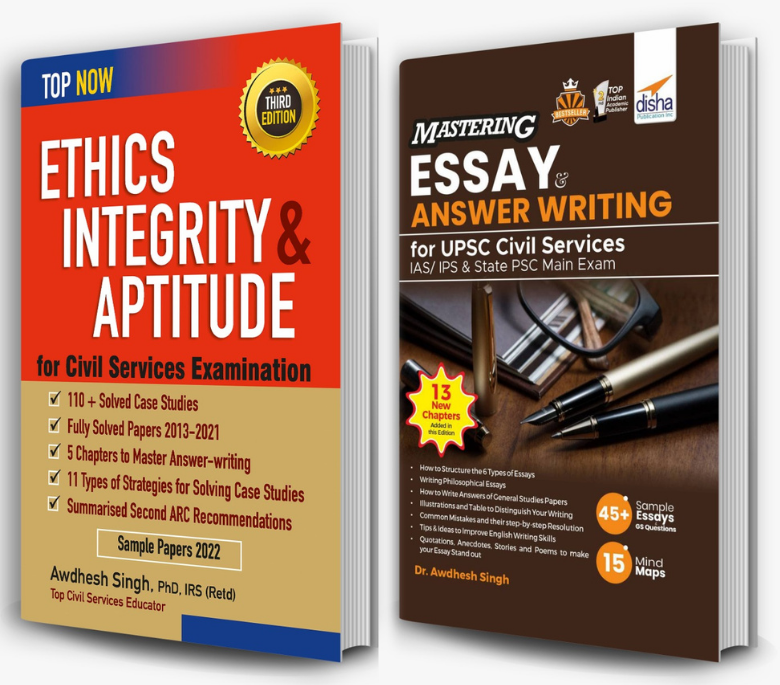

Looking for a One-stop Solution to prepare for ‘Ethics, Integrity, and Aptitude’ and ‘Essay and Answer Writing’ for UPSC?

Buy Dr. Awdhesh Singh’s books from the links below-

Ethics, Integrity & Aptitude for Civil Services Examination

Amazon - https://amzn.to/3s1Qz7v

Flipkart - https://bit.ly/358N2uY

Mastering Essay & Answer Writing for UPSC Civil Services

Amazon - https://amzn.to/3JELE2h

Flipkart - https://bit.ly/3gVIwmv

| Related Articles |

| Recent Articles |