Topics

All

Civil Services in India (26)

Ethics, Integrity and Aptitude

» Chapters from Book (11)

» Case Studies (8)

Solved Ethics Papers

» CSE - 2013 (18)

» CSE - 2014 (19)

» CSE - 2015 (17)

» CSE - 2016 (18)

» CSE - 2017 (19)

» CSE - 2018 (19)

» CSE - 2019 (19)

» CSE - 2020 (19)

» CSE - 2021 (19)

» CSE -2022 (17)

» CSE-2023 (17)

Essay and Answer Writing

» Quotes (34)

» Moral Stories (18)

» Anecdotes (11)

» Beautiful Poems (10)

» Chapters from Book (5)

» UPSC Essays (40)

» Model Essays (38)

» Research and Studies (4)

Economics (NCERT) Notes

» Class IX (14)

» Class X (16)

» Class XI (55)

» Class XII (53)

Economics Current (51)

International Affairs (20)

Polity and Governance (61)

Misc (77)

Select Topic »

Civil Services in India (26)

Ethics, Integrity and Aptitude (-)

» Chapters from Book (11)

» Case Studies (8)

Solved Ethics Papers (-)

» CSE - 2013 (18)

» CSE - 2014 (19)

» CSE - 2015 (17)

» CSE - 2016 (18)

» CSE - 2017 (19)

» CSE - 2018 (19)

» CSE - 2019 (19)

» CSE - 2020 (19)

» CSE - 2021 (19)

» CSE -2022 (17)

» CSE-2023 (17)

Essay and Answer Writing (-)

» Quotes (34)

» Moral Stories (18)

» Anecdotes (11)

» Beautiful Poems (10)

» Chapters from Book (5)

» UPSC Essays (40)

» Model Essays (38)

» Research and Studies (4)

Economics (NCERT) Notes (-)

» Class IX (14)

» Class X (16)

» Class XI (55)

» Class XII (53)

Economics Current (51)

International Affairs (20)

Polity and Governance (61)

Misc (77)

India’s fight against black money

Recent reports have suggested that the size of the country’s black economy has been estimated at 71-79% of the Gross Domestic Product (GDP) during 2009-2011. Black incomes were generated in different ways. Tax evasion resulted in generation of 65% of the black income in the country while non-tax corruption methods accounted for 20% of the unaccounted income, reveals one of the three top-secret study reports on black money prepared by three think tanks. What’s even more alarming is that even after multiple analyses using various methods, it has been concluded that there is no reliable way to quantify black money whether in India or abroad. The term ‘black money’ came into existence in the early ’20s. After the country started developing i.e. in the post-independence period, black money came under the limelight and now in the present, black money has become a dominative issue, moulding the national policies, determining new economic activities and sometimes determining the law of the country. The essay focuses on the problems of a black-money economy, steps that have been taken and ones that could be taken in order to curb it.

What is black money?

There is no official definition of black money in economic theory, with several different terms such as parallel economy, black money, black incomes, unaccounted economy, illegal economy and irregular economy all being used more or less synonymously. The simplest definition of black money could possibly be money that is hidden from tax authorities. That is, black money can come from two broad categories:

·illegal activity

·legal but unreported activity

The first category is the more obvious of the two. Money that is earned through illegal activity is obviously not reported to the tax authorities, and so is black. The second category comprises income from legal activity that is not reported to the tax authorities. For example, let us assume that a piece of land is sold, with the payment made in the proportion of 60% by cheque or electronic transfer, and 40% in cash. If that 40% cash component is not reported to the Income Tax Department, then it is black money. Another major source of black money is income earned by companies that is routed through shell companies abroad, thereby evading tax authorities.

The very definition of black money makes it extremely difficult to quantify. How is the government supposed to measure the economic activity that is actively being hidden from it? According to the Standing Committee’s report, the sectors that see the highest incidence of black money include:

·real estate

·mining

·pharmaceuticals

·tobacco industry

·bullion and commodity markets

·the film industry

·educational institutes

·professionals

How is it measured?

·Monetary method - it assumes that the existence of and changes in the share of unaccounted income is reflected in the stock or flow of money in the system. In other words, tracking the money in the economy to understand how much has not been accounted for.

·Global indicator or Input-based method - unaccounted income is modelled using a single universal variable with which it is assumed to be highly correlated, therefore these estimates are also called input-based estimates.

·Straightforward survey - it requires voluntary information from people and businesses concealing their incomes and so is quite prone to inaccuracies.

Causes for a ‘black economy’

Black money is one of the serious issues in many countries and when talking about a country like India it is one of the biggest issues. For India, it is not a new problem and has been in continuation since long back. Some major sources of black money include:

·Corruption - There are many reasons because of which black money is created in our country and corruption is one of them. Corrupt practices such as taking or giving bribes, transactions in black money done by bureaucrats, politicians, civil servants and high profile businessman leads to the creation of black money. The transactions in black money are rarely caught because of the high profile back-ups because of which the culprits are never caught by the government.

·Tax evasion - High rate of taxes often forces the earning population to not pay taxes and keep that part of income illegally with them which is later termed as black money. Tax evasion has led to the generation of a huge amount of black money in India.

·Foreign bank accounts - Foreign banks are safety lockers for the hoarders of black money. Especially the Swiss Banks, which do not disclose any information of their customers having an account in their banks have become the safest place for those who don’t want to pay taxes and hide their income from the government. Moreover, such banks have encouraged more and more people to generate black money. Examples of Nirav Modi and Vijay Mallya are the recent cases in point.

·Election campaigns - Campaigns conducted by the candidates for elections of parliament or assembly elections or any other elections at the local level leads to generation of crores of black money. During the campaigning for Lok Sabha Elections of 2019, more than Rs 3,166 crore worth cash, liquor, drugs jewellery was seized by the Election Commission of India and all of which was unaccounted.

Impact of black money on Indian economy

Black money has many adverse effects on a country’s economy. Other than the obvious economic repercussions, its social effects are many too.

·Loss of revenue to the government and running of parallel economy in the country both have a serious impact on the economy as it results in the reduction of government revenues.

·Vicious circle as a result of black money and corruption - black money only adds to corruption because of the illegal transactions which are made to hide the black money.

·Black money results in a low income of the government.

·Decrease in the quality of public goods & services.

·Difficulty in the formation of monetary and fiscal policy

·The illegally earned or the black usually gives rise to various illegal activities in society and corruption is one of them.

Steps towards a solution

Historically, various Indian governments have made attempts at curbing the growth of a black economy. Here, I shall outline the policies undertaken in the last few years.

·Legislative action - the government has already enacted several laws that seek to formalise the economy and make it necessary to report economic transactions. These include the Central Goods and Services Tax Act, the various GST Acts at the State levels, the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015, the Benami Transactions (Prohibition) Amendment Act, and the Fugitive Economic Offenders Act to name a few.

·Another method employed by the government to make it harder for transactions to be hidden is to mandate the reporting of PAN for transactions of more than Rs. 2.5 lakh, and the prohibition of cash receipts of Rs. 2 lakh or more and a penalty equal to the amount of such receipts if a person contravenes the provision.

·The Income Tax Department has also started monitoring non-filers of income tax returns using third-party information to identify persons who have undertaken high value financial transactions but not filed their returns.

·Demonetisation - was one of the biggest steps taken by the present government to curb black money from the country. On 8th November 2016 the central government declared the demonetsation of Rs 500 and Rs 1000 and introduced new notes of Rs 500 and Rs 2000. This initiative was taken by the government to curb various terrorist activities which were generated in the country and accelerate the economy.

·Benami Transactions (Prohibition) Amendment Act, 2016 - this Act prevents Benami transactions and has provision for confiscation of the benami property. The amended law provides that if a person is found guilty of offence under benami transactions by the court, he will be punished with imprisonment for a term not less than 1 year and can be extended to a maximum of 7 years, and along with that person will be liable to pay fine which can be up to 25% of the exact market value of the property.

Conclusion

The policies mentioned above have met with criticism from several forums. People have described them as ineffective, failed policies and a farce. However, many economists have infact pointed towards a large percentage of black money being held in cash in India would now be brought into the mainstream economy through the banks, which would bolster economic growth over the long term. Effective and credible deterrence is necessary in combination with reforms, transparency, simple processes, elimination of bureaucracy and discretionary regulations. Credible deterrence needs to be cost effective, claims the report. Such deterrence to black money can be achieved by information technology, integration of systems and compliance departments of the Indian government, direct tax administration, adding data mining capabilities, and improving prosecution processes.

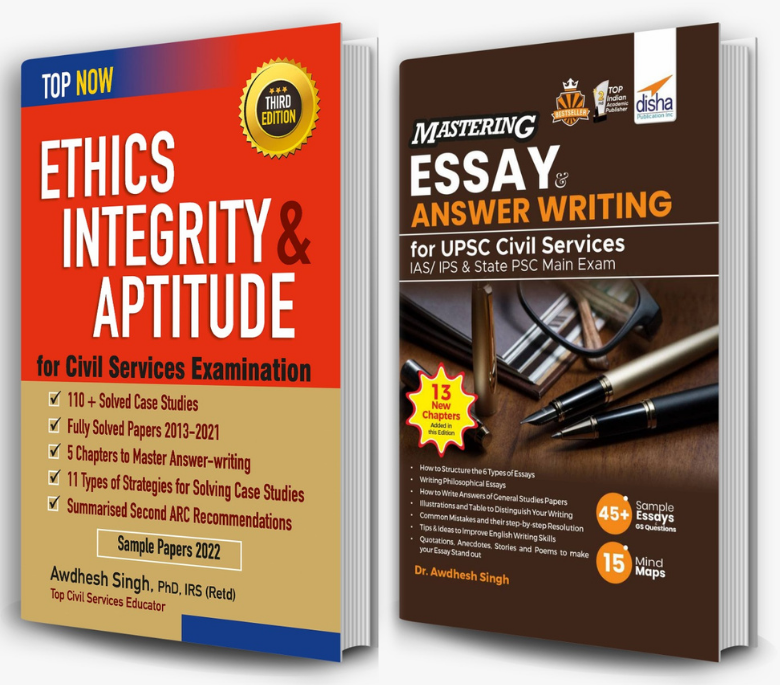

Looking for a One-stop Solution to prepare for ‘Ethics, Integrity, and Aptitude’ and ‘Essay and Answer Writing’ for UPSC?

Buy Dr. Awdhesh Singh’s books from the links below-

Ethics, Integrity & Aptitude for Civil Services Examination

Amazon - https://amzn.to/3s1Qz7v

Flipkart - https://bit.ly/358N2uY

Mastering Essay & Answer Writing for UPSC Civil Services

Amazon - https://amzn.to/3JELE2h

Flipkart - https://bit.ly/3gVIwmv

| Related Articles |

| Recent Articles |